A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later. Let’s switch quickly to the facts & myths now.

As discussed the credit score reflects upon your qualification for a personal loan. On one hand, a good score can get a considerable loan amount and on the other a bad score can be held responsible for an instant loan rejection/ accept high interest loan. So, its visible to say that a lot rests at stake according to the credit report/ score. Infact, many important decisions lay on this one report to facilitate lenders at required times. Also, as a responsible borrower you must possess knowledge of what is a credit report and what are the contents of it. This will only help to keep your credit history intact and take measures to make corrective changes.

What do you actually understand by a Credit Score?

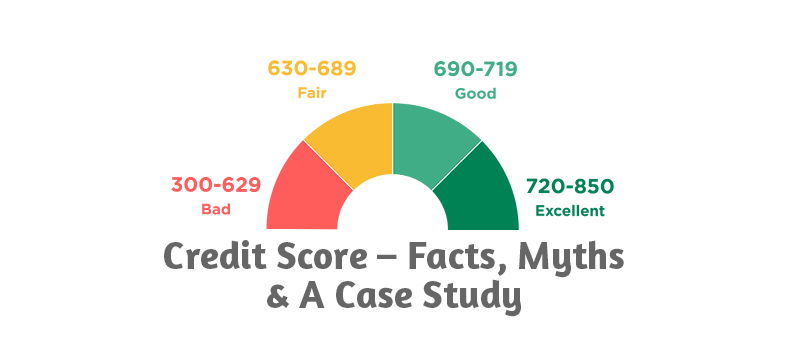

A credit score is a numerical digit which keeps track of your financial doings per se. You arrive at this score after taking into account different parameters like the financial behavior, repayment history, loan sanctioned, preferred loan type, defaults & penalties. The score remains within the bracket of 300-900. Conventionally, a score over 800 is considered ideal for lending institutions and acceptable for granting a credit card/ personal loan. Infact a score above 750 is quite decent as well. Now, a score between 600-700 may not significantly be understood well. This evidently shows that you could not keep up excellent financial management and hence landed into trouble. But if your score drops below 600, then it’s a signal that you failed at managing funds well and need immediate corrective measures. A low credit score can also lead to straight rejection of your personal loan application.

So, What Really Impacts Your Credit Score?

There is enough hue & cry about how your credit score gets impacted. Different factors are usually accountable for a bad/ good credit score. Let’s talk about the most common ones. Have a look below:

Default in EMI

Repayment defaults can be considered harmful for your credit score. It pretty much shows in your report that you erred in your credit transactions however a recent mistake will cost higher than an older one. The impact of the past transactions keep falling eventually.

Multiple Trials

When you need instant cash, you generally seek a credit card or personal/short term loans. For this, you check on different lending institutions. So, too many loan requests can negatively showcase your credit history, which thereby leads to poor credit score.

Types of Loans

The types of loans you already have determines your credit score. So if you’ve unsecure loans like credit card or personal loans, then your score will be further worsened. However, if you have car or home loans, then your score is reserved.

Outstanding Debt

If you’re growing on the outstanding debt, then your repayment liability is also increasing. After a certain point, your credit score gets really heavy.

Myths

There is a huge heap of misconceptions related to a credit score. Let’s a quick look at all of them right away:

Previous Record

If you have a record with the credit bureau, then it that doesn’t necessarily mean that you’ve gone wrong. All bureaus maintain ledgers with good or bad credit records.

Several Credit Cards

Even if you have many credit scores, it doesn’t mean that you will be help up. It is about how you use the credit that matters more. Many credit cards/ personal loans do not put you down. The best utilization of the credit is considered utmost.

Low Income

Your income has nothing to do with your Credit Score.

Age

Your age has nothing to do with the credit score.