Personal loans are a popular option for people who need quick access to funds for various purposes, such as debt consolidation, home renovation, or medical emergencies. However, when you take out a personal loan, you also commit to repaying the borrowed amount in equated monthly installments (EMIs) over a predetermined period. Missing an EMI payment

Author Archives: abhimanyu

Jan

This is a purely subjective matter. If you’ve got the financial means, you may want to reckon giving money to family members with no strings attached. For this financial year, family members can lend as much as they like as an individual without triggering gift tax laws. Loan to Family member Tax Implications India Does any loan to a family

Aug

Are you thinking to cancel your credit card? Before you think of cancelling your credit card, think twice! You must take appropriate steps into consideration before closing your credit card for good with minimum damage to the credit score. How to Nicely Cancel a Credit Card Here’s an agenda of how to nicely cancel a

Jul

Small businesses are believed to be the power house of the Indian economy. However, these businesses are scared of the complex lending process through the physical centers. This can be really frustrating for the takers & providers both. Too many times, we observe how growing companies reach a saturation point when they do not how

Jul

Aarogya setu is a brilliant app as an initiative to connect essential health services to Indian citizens to keep their fight alive against Covid-19 pandemic. Amidst this crazy scene, Aarogya Setu has substantially helped to keep tab on the coronavirus cases & track patients in your vicinity. This GPS enabled app helps you to spread

Jul

According to experts, Covid-19 pandemic has hit harder than the financial crisis of 2008-09. During this time, it’s important to take action with effective fiscal packages to take control of the situation & feed the poor/underprivileged. In-fact, the pandemic is striking back & forth through different channels. We are witnessing major supply issues and lakhs

May

Are you an aspiring therapist? We are sure that you’re no stranger to hard work already. Maybe you’re dealing with multiple issues like prevalent existing debts, bad health, and financial mismanagement. Looking at their heightening careers, you may feel the pitch a bit. One could be determined early to move beyond the ordinary & create

May

There are special financial ‘to-dos’ to tackle while you’re spending time at home mostly. If you’re on house arrest due to the lockdown orders, then here comes your chance to tackle your financials like never before. You could just cover all the tasks put off till date. Also, if you’re working from home and not travelling to

May

It’s true to say that family stays forever, their health holds equal importance. All members would keep healthy when they give each other time. Family time is vital to create bonds, lasting love, healthy conversations and relationship among the family members. Family time also helps to cope with challenges, infuse a feeling of security, inspire

Apr

The Government of India has been on the forefront to combat Covid-19 pandemic eversince it spread-out in the western part of the world. Visible measures were observed in terms of necessary barricading, curfews, supply of essential goods, food distribution to needy families and most importantly issue strict directives to protect oneself & close ones. The

Apr

Are you thinking to take up an accounting career? Based on your aspirations, it’s important to take a decision on the certifications & degrees. A higher degree is better for a lucrative accounting profession, however, it comes with a high price too. The majority of the students who aspire to take up an accounting career

Mar

Mumbai is another name for the modern & contemporary. It is supposedly is known for its vogue & upmarket approach. It is marked on the Konkan coastline serving a population of 1.84 crores approximately. Mumbai is also quite commercial for its million-dollar businesses and vocations. However, it is soon squeezing with more and more people

Mar

Often the term ‘financial planning’ can be heard. But is it just having money and some bank balance? While this is partially right, financial planning covers even some broader aspects which just not limit an individual for particular periodic planning but for a longer period of time. What Is Financial Planning? When this comes in

Mar

When difficult times fall upon you, an individual may consider borrowing from close members to forgo complicated application & approval processes of banks & other financial institutions. This is quite liked by prospective borrowers who do not have all the documents ready to especially have approvals in place to qualify for loan approvals from banks.

Dec

We are in the era where digitization is the key to an overall development of a country. We are growing good with our countrymen who trust us & want to join hands. In the year 2018, about 70 lakh unique visitors came to buy our loan products to make a comparison and write good stories.

Dec

Today, Banks/ NBFCs present ready offers to their existing customer base, without the need for complicated documents or formalities. Plus, the process is generally unwieldy and automated. Customers are usually interested to go to their host banks for loan application. This greatly saves them from long drawn documentation, uninvited calls, long bank queues, complex procedures,

Nov

A personal line of credit can pose to be a prized facility to assist individuals in planning and executing their financial life. To have quick access to the credit line to take advantage of the upcoming opportunities is essential. Not only will that meet short term goals but also work towards a powerful future plan.

Oct

A few things never go well together, like oil and water. Similarly, personal finances and your business funds cannot be mixed. If you keep clarity on these grounds, then it will be much easier to manage your financial worries. Although, it’s difficult to put set our article into motion. How best to bifurcate the major

Oct

From the beginning of our career, we channelize our efforts to build an owned house. Our house strongly reflects upon the basic character and life aspirations. So, the focus should be on building a house as early as possible in our professional span. Once built, there are several other commitments to be met. The essential

Sep

Typically, you opt for a home loan to buy a property or build a house on it. There can also be times when your house needs a touchup, and then again your home loan backs. It can be a renovation, extension or repairs to the existing property. So even before we contemplate the idea of a

Aug

As we already understand, a home renovation loan is considered to make beauty changes to your existing property. Home Improvement Loans are smaller loans for fitment to smaller needs. This type of loan pretty much covers your house improvement treatment, whether with a new piece of construction, newer interiors, or overhauling of the existing property

Aug

Under the most general cases, lending institutions provide specific personal loans for working capital, property purchases, financing home improvements, inventory stock, so on and so forth. However, if your plan is to start small, then it’s quite simple to have a personal loan approved. If you’re sure of getting revenues out of your small beginning,

May

Want a loan but worried about your eligibility? There are ways to know if you are eligible to avail a loan. You can check it online and know the factors that contribute to the eligibility of the loan. Here are some of the factors that decides the eligibility of the loan for any individual. Documents

May

Just as difficult as it sounds a loan can be sanctioned by a bank, NBFC or an online P2P lending platform. P2P lending platforms are basically NBFCs as watched by RBI and the statutory bodies. The online lending platforms are the building blocks between investors and borrowers. Many online lending platforms entail a small charge

May

Majorly, personal loans are long-term and have high interest rates on the lent amount. However, there are a few personal loan types which can be taken for shorter duration also. A depositor can easily visit a bank for demand loan against old deposits, National savings certificate, LIC policy etc. What banks do is that they

May

Home loan or housing loan is a certain amount of money borrowed by an individual to purchase a house or any piece of residential property for a specific time period. The amount is lent with some interest amount that has to be paid along with the principal amount. Eligibility to get a Home loan Decided

May

Very often we take a small loan at first. However, as time goes by we build more trust with the brand. Alongside, we start to like the concept of personal loans! Many lending institutions are open enough to offer a second loan. This could be basis the individual’s financial behavior and repayment pattern. The lender

Apr

Credit utilization is defined to be the ratio of outstanding credit card balance to credit card limits. It gauges the amount of credit in use. It takes care of the amount of credit limit you are using. Let’s assume that if your balance was 3 whereas your credit limit was 10, then the credit limit

Jul

Taking a loan with a partner may increase the chances of loans getting approved. Also, you get to share the number of instalments which you would have to pay once the loan has been disbursed. But, as the management says, “Be wise”. Just do not pair up with anyone in order to avail the loans.

Jun

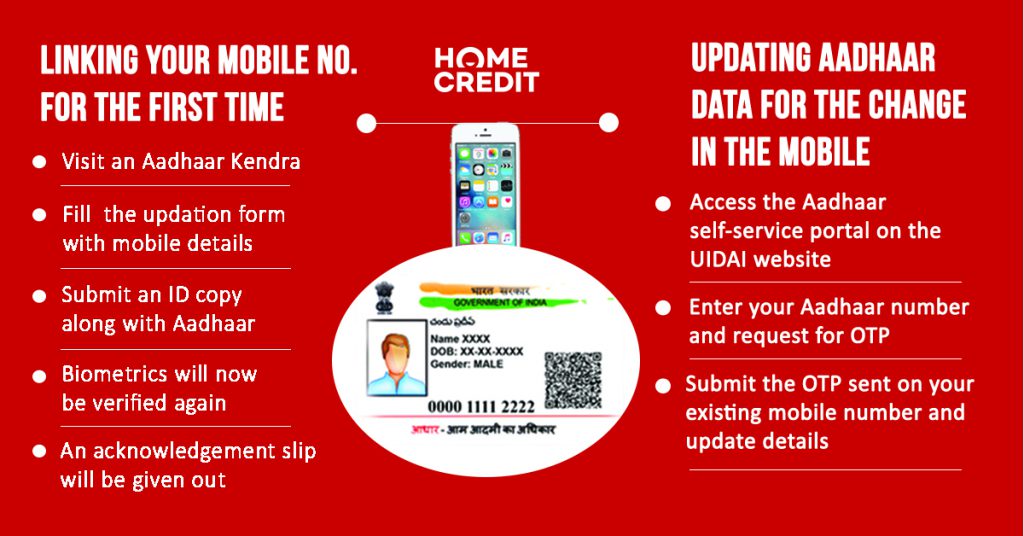

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID. One of the major benefits of this new process is that it will let organizations fetch only the information

May

About 1.2 billion people have an Aadhaar number today which is about a whopping 99% of the adult population of our country. Launched by UIDAI a decade ago, Aadhaar is apparently forming the world’s largest biometric identification system. The reign of Aadhaar has successfully stayed too long and is giving citizens another benchmark to embark

May

A few years ago, the lending process in India was cumbersome where one had to make multiple visits to the bank, stand in long queues, bring an endless number of documents and proofs for verification and then wait for weeks to hear from the bank. Does it sound feasible in the busy times today? In

Apr

According to a latest report* India is all set to overtake China in 2018 to become the world’s fastest-growing large economy and since half of India’s population is middle class, there has been an exponential growth in the loan sector as well. The Bank loan growth in India** increased significantly from 4.10 percent in March

Feb

Savings on tax is a crucial aspect of personal finance of every household. Of the multitudinous taxes on the common man, one of them, a major one, which burns a hole in the pocket, is the Income Tax. If you earn more than Rs.2.5 Lakhs per annul, then you are in the income tax net.

Feb

The mantra for a good financial health is to save money from income and then go about your monthly expenditures. However, we know that inflation, as well as the standard of living, is increasing day by day, thereby eroding the value of your savings. Thus, it becomes crucial to start investing your money. Also, nowadays

Jul

In the era of e-commerce when we have come to accept online discounts and cashback policies as the order of the day, it was but inevitable that a digital platform for trading and investments was to follow suit. In fact, the advent of a digital platform for investments has made life easier for many investors

Jun

Financial flow in everyone’s life is different than what we think. But we have all those bad spending habits that break the budget on a monthly basis. Here are 6 suggestions you can adopt in your daily lives to keep a check on your monthly budget. GET RID OF STUFF YOU DON’T USE:- Take a

May

While it is true that we definitely learn from our mistakes, but a mistake every time cannot give you again an option to stand. And especially when it is something related to the financial part, it hurts and probably a lot. In order to avoid such mistakes, it is very essential to do your calculations