A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment. Your CIBIL Score indicates financial stability and helps the lenders in deciding if lending to you is worth taking a risk or not. Simply speaking, CIBIL Score explains the probability of a borrower paying back

Credit Card, Credit Card Tips, Loan

How Can a Good CIBIL Score Help You Celebrate the Festive Season Better?

Nov

The festive season brings joy, warmth, and a chance to create lasting memories with family and friends. From Diwali lights to Christmas cheer, it’s a time when celebrations are in full swing. While the festivities add a sparkle to our lives, they often come with additional expenses. This is where your Credit Information Bureau India

Jul

As consumers, our tendency for obtaining items on credit is at an all-time high in this credit-driven economy. Your CIBIL score or rating is based on your CIBIL report, which is a detailed summary of your credit history & record. Credit scores are not only calculated on the basis of your present actions but also on your past behaviour regarding your credit

Feb

Don’t even think about canceling that card before you do these five things. Canceling unused credit cards can free up room in your wallet and give identity thieves one less way to come after you, but it’s not as simple as you might think. There are some loose ends you have to tie up before

Dec

Nowadays, in and around the financial environment, every lender looks at your credit score before considering your borrower profile. On the basis of credit history, it’s much easier to assess the potential risk of losses/default. This is exactly why borrowers are looking forward to finding out their credit score & for free. However, it’s important to stay cautious & keep a few pointers in mind. Avoid being trapped

Jul

There’s no surprise to reveal that a credit report reflects on your past credit transactions. It tells us clearly if we’ve paid our loans on time & took notice of our falters. This substantially helps in getting us another valuable loan. Understand the value of your credit report through a fresh perspective As a responsible father, you may have big dreams about your

Feb

Are you carrying multiple credit cards in your wallet? If yes, then you’re no less than a credit addict. You’re bold, risky averse & experiential in life. This is the clearest sign of your madness for credit. According to a general survey, there are too many credit card users than ever. And this is plainly

Nov

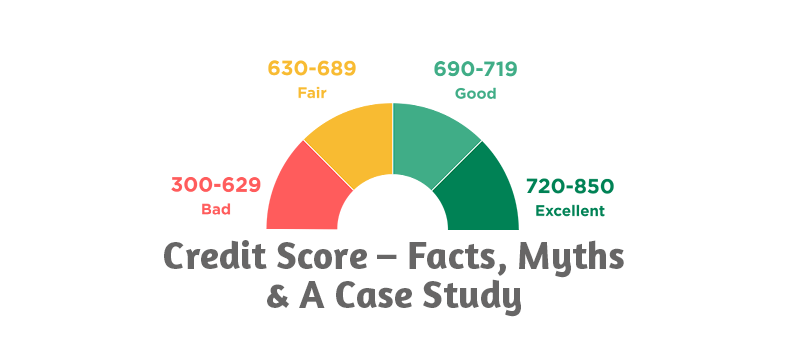

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later. Let’s switch quickly to the facts & myths now. As discussed the credit score reflects upon your qualification for a personal

Aug

To determine a credit score, several factors are considered as the type of employment, repayment potential, personal assets are verified before providing a loan. Practically a credit score of 650 is quite low, yet it is optimistic to take your chance. It is equally important to know that a prospective borrower will have no history

Jul

The common perception among borrowers may be that a credit score of 650 or lower can be risky for their loan instinct. And perhaps its true! It is difficult to have a loan with a credit score of 650. Prominent banks propose a higher score of 750 or more. This is primarily strategic well to

Apr

We know that there are parameters to check the health status of an entity. Be it physical health, automobile health, or financial health! A standard parameter gives the right information as to how we are doing. So, when it comes to the financial health of an individual, then the CIBIL, formerly known as Credit Information

Jul

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment. Your CIBIL Score indicates financial stability and helps the lenders in deciding if lending to you is worth taking a risk or not. Simply speaking, CIBIL Score explains the probability of a borrower paying back