Personal Loan For Marriage

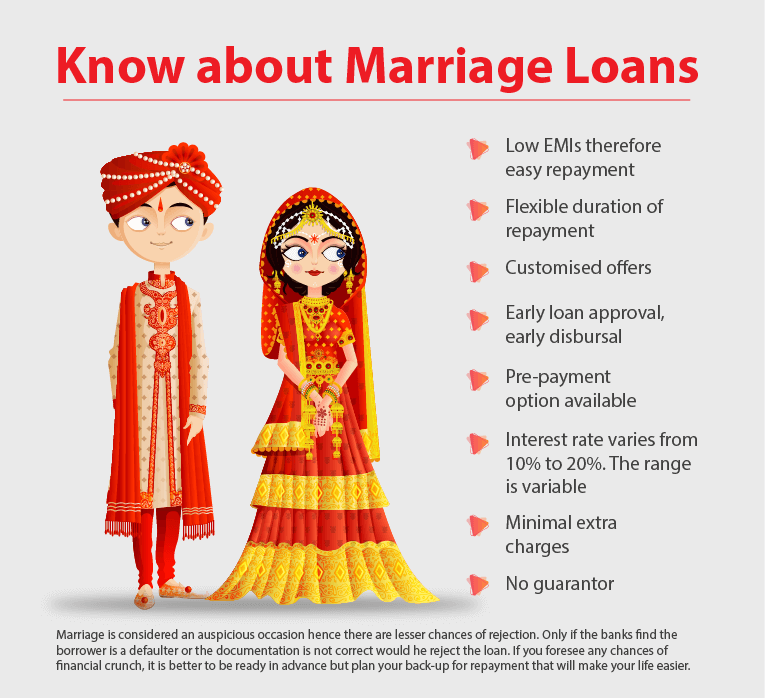

Marriages nowadays do not mark an auspicious ceremony to be celebrated but an extravaganza hence seeming an impossible thing to bear the expenses. Everyone wishes to make this big day memorable with everything set in place however in the flow of action, we forget to manage the finances.

You can make your day memorable and not to run out of finances, you can opt for Home Credit Personal Loan for Marriage or Wedding with minimum documentation.

- Quick & Easy

- 100% Paperless

- Instant Online Approval upto INR 2 Lacs

- No Hidden Charges

- Quick Disbursal