Personal Loan For Medical

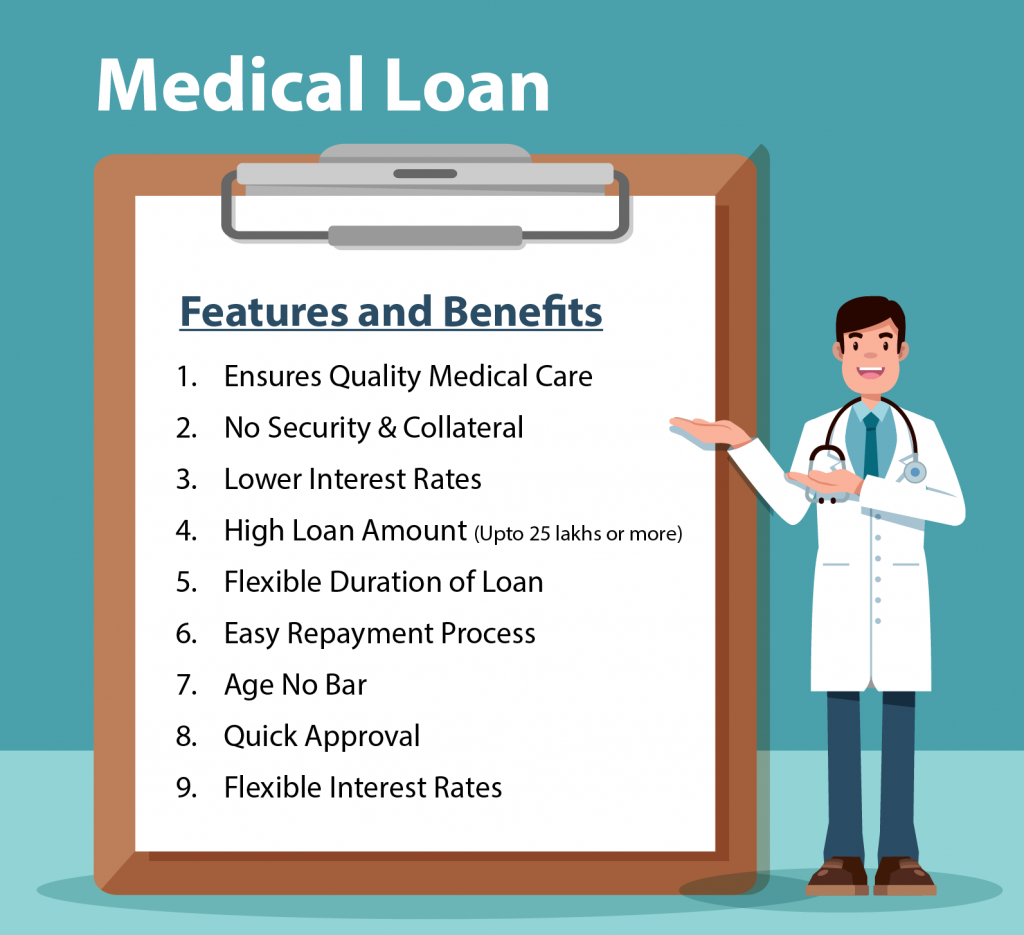

There is a point in time when there is situation of medical emergency that demand hefty funds. It can be due to acute illness, accidents, any surgery recommended by doctor on urgent basis or any other medical requirement.

In these times, you can take Personal Medical loan to help you deal with medical related expenses. From medicines to hospital bills all can be catered with our personal loan up to 2 lakhs.

- Quick & Easy

- 100% Paperless

- Instant Online Approval upto INR 2 Lacs

- No Hidden Charges

- Quick Disbursal