Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes, such as debt consolidation, home improvement, or unexpected expenses. When it comes to personal loans, borrowers can choose between short-term and long-term loans, depending on their financial needs and preferences. In this blog, we will

Author Archives: Home Credit India

Mar

Holiday season is one of the most exciting times of the year, but it can also be expensive. From flights and accommodation to food and activities, holiday expenses can quickly add up, leaving many individuals struggling to finance their dream vacation. If you’re planning a holiday and need financial assistance, taking a personal loan may

Mar

The year 2023 is here, and it’s time to start planning your finances. While there are many ways to manage your finances, sometimes unexpected expenses can put you in a financial crunch. Personal loans can be a useful tool in helping you avoid financial difficulties. In this blog post, we will explore how personal loans

Mar

Education is essential in today’s world, and it’s never too late to pursue higher education or upgrade your skills. However, the cost of education can be a significant barrier for many people, especially when it comes to pursuing a degree or certification that could lead to a more lucrative career. In such situations, a personal

Mar

Holi is a vibrant and colorful festival that brings people together to celebrate the arrival of spring. The festival is celebrated with great enthusiasm and excitement, with people indulging in colorful festivities, music, and food. However, the expenses associated with the festival can add up quickly, leaving you with a hefty bill to pay. This

Feb

As a couple, Valentine’s Day is the perfect time to set meaningful financial goals. Achieving those goals can help you create both a secure and comfortable financial future. Here we will discuss a few key steps you can take to help set financial goals as a couple this Valentine’s Day, including establishing a joint financial

Jan

CIBIL (Credit Information Bureau (India) Limited) is a credit information company that maintains records of an individual’s credit history, including credit cards, personal loans, and home loans. A CIBIL score is a three-digit number that ranges from 300 to 900, and it is used by banks and financial institutions to determine an individual’s creditworthiness. However,

Jan

Credit risk management is an essential part of any financial institution, as it helps to ensure that they can meet its financial obligations and maintain a healthy cash flow. Credit risk refers to the potential for a customer or borrower to default on their loan or credit obligations, which can result in significant losses for

Jan

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan. The borrower’s credit history is essential in these situations since the lender,

Oppo A16 Need a phone with an excellent display, good cameras, and a day’s worth of battery life? The Oppo A16 offers everything. To keep your eyes comfortable day and night, its 6.52″ HD+ display maintains your preferred brightness levels. On the back, there are three AI-powered cameras, so you can always capture stunning pictures. Additionally,

Jun

We all have goals in life, whether it’s to buy the best smartphone to pursue our passion for photography or to buy the latest refrigerator for our mothers to proudly display in their kitchens. It goes without saying that making big purchases needs financial planning and commitment. However, with the Home Credit Ujjwal EMI Card,

Jun

Modern appliances and gadgets are expensive, and you may struggle to pay for them upfront at times. With the Home Credit Ujjwal EMI Card, you can shop for the latest products on No Cost EMIs** and pay for them in convenient monthly instalments without risking your other financial commitments. It’s a blessing to be able

Jun

Small things in life can bring a lot of joy to your family. Buying a new television or laptop is a satisfying experience. However, you may not always have the funds to make such purchases. Shopping on EMI is an excellent and affordable solution for this. Let’s take a look at the benefits of EMI

Jun

Shopping is more than just a way to get what you want or need; it’s an overall experience, whether you’re just browsing or buying something. However, for many people, affordability is a major barrier to buying what they want or need. Despite the fact that this has become much easier in recent years, people continue

Jun

Nowadays, shopping on EMI is the new trend. On EMI, you can buy anything from electronics to home appliances. Although the process of shopping with EMI cards and credit cards is very similar, there are some differences we should know about. We have been using credit cards for a long time. They help us make

Jun

The online shopping culture in India has gained a lot of popularity over the previous decade, and the COVID-19 situation has accelerated this trend. Shopping for your favorite products has become much easier with access to numerous online shopping platforms as well as offline shopping centers. While having access to a large selection of products

Jun

Everyone has a monthly budget, and one unexpected expense can completely derail it. But what if you want to buy something but don’t want to break the bank? The answer is to shop on EMI. When you shop on EMI, you can get practically everything you want while making it affordable. You can convert the

Jun

Most of us cannot picture our lives without home appliances. These appliances help us complete most of our everyday tasks. We can’t store food or do laundry efficiently without a refrigerator or a washing machine. We are more comfortable when we have more useful appliances. Often, outdated appliances may begin to malfunction, causing you to

Jun

If you think EMI shopping is only for expensive cars and houses, you’ll be relieved to know that this is no longer the case. You can buy a variety of gadgets and home appliances on affordable EMI without using a debit or credit card. Isn’t that appealing? We are all spending the majority of our

Jun

Owning a smartphone has become a necessity in recent times, regardless of our age or career. A high-end smartphone makes all our daily tasks easier, from completing professional projects to shopping online, entertainment intake, and communicating with friends and family. We have to update our mobile phones every couple of years or so due to

Jan

We are all battling with financial issues today, as we are in the midst of the pandemic. An instant personal loan can help you deal with issues like this right away. Applying for a personal loan is a hassle-free way to take care of your immediate financial needs, especially in the midst of the pandemic.

Jan

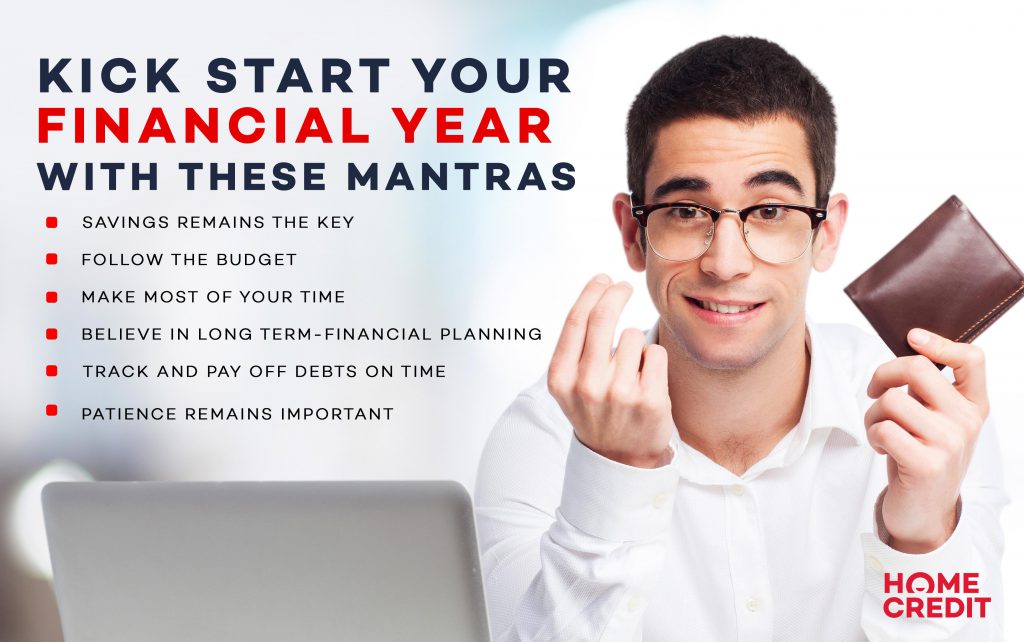

Who wouldn’t like to be rich and successful in life? We have all had dreams about doing something big and earning a lot of money in our future. But how often do we stick to our dreams? Focus, Patience, and hard work remain the utmost important aspect before we step on to anything in life

Jan

Buying your dream house and keeping up with its regular maintenance can be expensive. If you are looking forward to renovating your home but falling short of money to pay for the project, applying for a personal loan for home renovation makes sense. Whether you are planning for an urgent repair or just want to

Jan

Tackling your financial goals, whether they are to design your ideal kitchen or to finally pay off your credit bills, can be expensive. Taking a personal loan, on the other hand, can be helpful. Personal loans are usually unsecured loans, meaning you do not have to provide any collateral or pledge any asset to secure

Jan

A medical emergency might happen at any time, which means you will need money to cover your medical expenditures. Environmental factors and city living are two of the most important aspects that influence your health and place you in risky situations. Furthermore, the soaring healthcare expenses associated with this pandemic complicate the situation. But what

Dec

You may require funds for a wedding, home improvement, higher education, vacation, medical emergency, or debt consolidation, among other things. If you are not financially prepared, the cost may deplete your savings or worse, severely affect your financial health. Personal loans come in handy in this situation. They not only provide a considerable sum of

Dec

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life. To help you, here is all you need to know about credit scores. What is a Credit Score? A credit score is a three-digit figure that

Dec

Major expenses can strike at any time, so do not allow them to deplete your savings. Whether you are strapped for cash for a wedding, a home remodel, or a family holiday, a quick personal loan can help you achieve your dreams and live your life to the fullest. A personal loan provides a lot more than

Dec

From time to time, we always have crucial decisions to make, and chances are that it will cost money! Whether it is a new home appliance, an automobile or a house renovation, or any other personal reason, one needs a substantial amount of money to achieve what we desire. In such circumstances, a personal loan

Dec

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan. These lengthy application processes not only made availing a personal loan a mind-numbing affair, but also encouraged people to opt out of the process mid-way. However, due to technology disruption, financial

Jul

As consumers, our tendency for obtaining items on credit is at an all-time high in this credit-driven economy. Your CIBIL score or rating is based on your CIBIL report, which is a detailed summary of your credit history & record. Credit scores are not only calculated on the basis of your present actions but also on your past behaviour regarding your credit

Apr

As the second wave of the coronavirus engulfed India, people not only panicked as the number of cases rose, but they are also constantly falling prey to the myths and misconceptions around COVID-19. As scientists and medical professionals work to create a clinically approved vaccine to treat patients and stop the virus from spreading, people

Feb

Don’t even think about canceling that card before you do these five things. Canceling unused credit cards can free up room in your wallet and give identity thieves one less way to come after you, but it’s not as simple as you might think. There are some loose ends you have to tie up before

Jan

Whenever you’re considering a business loan, it’s quite common to hear different opinions on its application & use. Everyone will have a story to narrate in relevance to funding a new startup. Though, you do not need to pay attention to all hearsays. Of course, taking a loan to start up your venture may or may not sound suitable due

Jan

Are of scared of wasting too much money? Are you confused about the available choices? You can immensely save on your engagement ring by ensuring that you don’t overpay for a feature that’s not important. Essentially buy your diamond from a reputable showroom/vendor. Saving your money is an excellent practice however while buying an engagement ring, you can let go! A few small sacrifices can really make

Dec

As humans, you like to approach and seek money from friends or family first, however they may or may not like your act of borrowing. Money has also been the determinant of many crucial relationships by judging its foundation. So even when money forms an important part of life, we still judge when someone’s fallen

Nov

Generally, couples should plan their financial future in advance. This must be including times when they are planning a baby. Having a baby involves the largest part of financial spending which may require a lot of preparations. Every possible step towards saving and investing must be explored before the baby finally arrives. It is even more important even you’re working and planning to quit to have a smooth time of birth. Of

Nov

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours. However, we live in a world that is not so ideal, where not all of us have a stellar credit score, and not everyone can guarantee a

Oct

Agra is the city of Architectural greatness where many small businesses have found their hold. Taking a personal loan can be extremely useful for small set-ups or budding ideas to meet working capital needs. It is quite possible to realize the costs at later times when it bundles up to a deficit. Costs spent on a business can be way more than expected. Whether it’s a small or

Oct

Our lives have literally changed during this self-imposed quarantine & Covid 19 pandemic. It’s probably the worst to happen to all of us being so social & people friendly. The national tragedy has been constantly shaping our temperaments, lifestyles, ideologies, etc. Also leaving the corporate giants to formally recognize work from home as the latest way of working. This must be accepted as the “new normal”. This convenient

Sep

Today’s generation is extremely enterprising in its thinking and ideas. So are women! The financial system looks to be pumping equality between men and women. A large portion of the women workforce is bending towards independent careers and making it big through startup ventures. Here, the Indian economy is greatly encouraging the women entrepreneurs to build an empire of their own. Women

Sep

It’s a universal truth that funds are a catalyst to every business set-up, whether it’s big or small. Money funding is significant for all kinds of projects to make a beginning or leave a mark. Whatever may be your reason to take a loan, every business loan is different. A few will generally have rigid credit standing and documentation procedures which raise the rates of interest. There are

Sep

When housing prices surge, people start to sell their house. They make up their mind to move to a much cheaper place of residence. And then sometimes they plan to stick to their current residence & put relentless effort to make it easier to live into the same place. Certain improvements can surely be made

Sep

Whatever one can afford depends completely on his/her income and another share of expenses, like education loan instalments, groceries, basic clothing, etc. There are different logics you can apply to set up how the rent will be deducted from your salary & help provide apportionment of the remaining. Let’s have a look as given under: 1. The 30% rule Precisely, this popular rule of thumb is about spending 30% of

Sep

In the past few years, small businesses have found an economical route of social networking sites/apps to promote their business and have taken advantage to spread the word digitally & otherwise. Today, the digital channels have a strong presence in lives of all of us. In the same way, WhatsApp has played a collaborative role

Sep

Today you will find a gamut of books written around personal finance as the core like money, finances, entrepreneurship, investments etc that helps to take the right path. To know anything deeper, you should have enough knowledge about it & for which you should learn and read to get a better understanding. To have your financial well-being improved, you must have a good read of

Aug

One of the best personal finance concepts we’ve ever heard is of the ‘emergency fund’. A good chunk of people disregards the idea of using emergency funds as an essential part of personal finances. However, they fail to anticipate their ultimate use during tight spots. Emergency Funds Are the First Line Of Defense Against Financial insufficiencies An emergency fund you

Aug

Change is the only ‘constant’ in our fast moving & busy lives. And we get to see how closely our daily expenses & market competition are intertwined. In the effort of earning money, we continue to struggle to fulfil our life dreams. Our everyday usually consumes us so much of our time (travel, work, household

Aug

Are you looking for a credit card to shop for your favourite items? Typically, the younger generation, office class likes to get the best cards for shopping & lifestyle in India. These cards offer benefits across multiple spending categories such as shopping, dining, etc. So now you can experience a host of lifestyle privileges, cashback offers, rewards, & features like never before. In fact, during

Aug

The habit of saving money can turn out extremely useful if taken up seriously. It is the mantra to “Think and Grow Richer” for improved financial success. To keep enough money saved can help you through tough situations whether it’s a medical emergency, getting admitted to top b-schools, starting your own venture, or going abroad for business meetings. Savings

- 1

- 2